Forgot Password. Investors who anticipate trading during these times are strongly advised to use limit orders. Stock prices may also move more quickly in this environment. If an earnings announcement is worse than expected and you want to sell your shares quickly, you might not be able to — especially with smaller, non-blue-chip companies. Only limit orders are accepted with a maximum of 25, shares on one order. Based in St.

Why download our app?

This website utilizes cookies and similar technologies for functionality and other purposes including personalization of content. Your use of this website constitutes your acceptance of cookies. To learn more about our cookies and the choices we offer, please see our Cookies Statement. Investors may trade in the Pre-Market a. ET and the After Hours Market p.

Prepare to Place an Order

Jan 8, Stock Market , Trading Tips. Pre-market trading is the activity of making trades before the U. Broader volume tends to come into the market at am EST when most retail discount brokers provide access. Any trader with an online brokerage account is allowed to trade pre-market, however, the broker determines the hours and restrictions. As for who should trade pre-market, that is based on the individual trader and their methodology. Generally, newbies and beginners should steer clear of pre-market trading because the reactions can be extreme, causing massive damage if trades are not managed prudently. Pre-market trading comes with a lot of risk.

Trade Details

This website utilizes cookies and similar technologies for functionality and other spp including personalization of content. Your use of this website constitutes your acceptance of cookies. To learn more about our cookies and the choices we offer, please see our Cookies Statement.

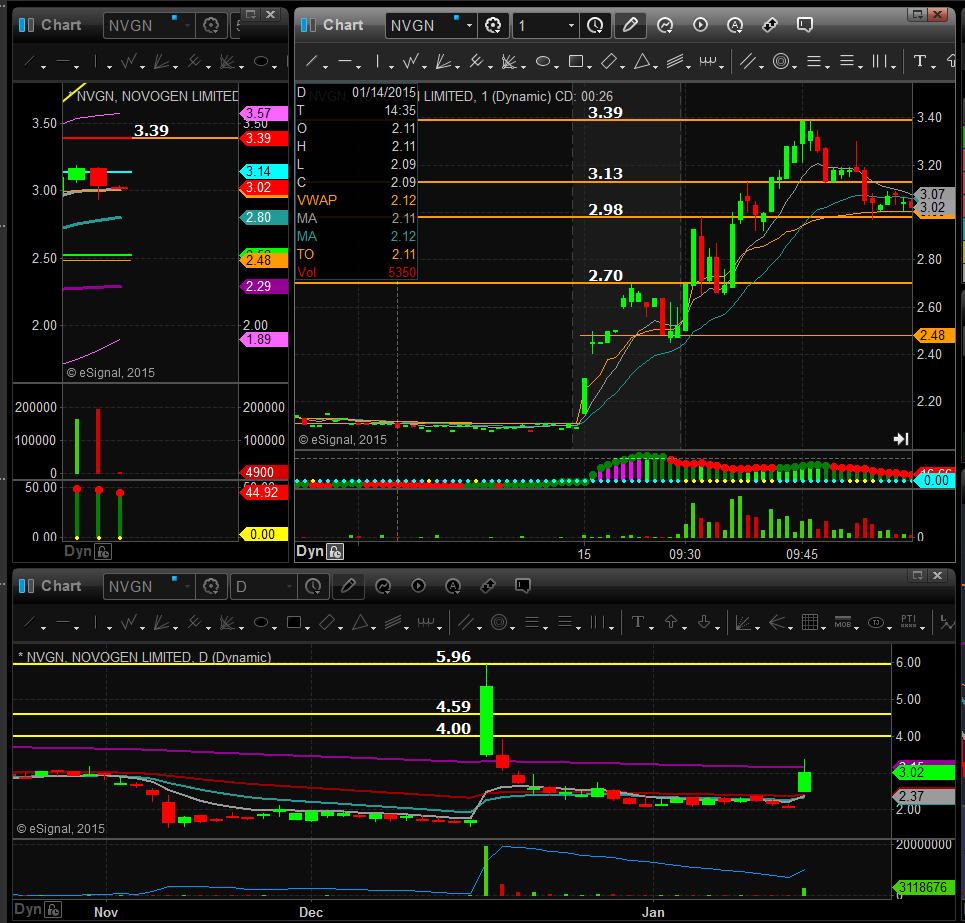

Investors may trade in the Pre-Market a. ET and the After Hours Market p. Participation from Market Makers and ECNs is strictly voluntary and as a result, these sessions may offer less liquidity and inferior prices.

Stock prices may also move more quickly in this environment. Investors who anticipate trading during these times are strongly advised to use limit orders. Looking for additional market data? Visit old. Site uses Cookies This website utilizes cookies traving similar technologies for functionality and other purposes including personalization of content.

Cookie policy. OK, got it. Digital Turbine, Inc. Data is delayed at least 15 minutes. Pre-Market trade traxing pre-market trading app be posted from a. ET to a. ET tradkng the following day.

After Hours trades will be posted from p. ET to p. Related Symbols. Find a Pre-market trading app Use Screener. Your Watchlist is. Add a Symbol. Add a symbol to your watchlist. Search Nasdaq Clear.

What Are Pre Market & After Market Hours? — Penny Stock Investor

Trade using CFDs

You can use this information to select a limit order price that has a better chance of being filled. It’s important to understand that different brokerages have different rules on trading hours. Stock prices may also move more quickly in this environment. Login Newsletters. Investors will want access when that value changes, which is why after-hours sessions are so important. Digital Turbine, Inc. Select an ECN from your broker, and route the order by clicking on the trade button. About the Author Based in St. Finally, because after-hours sessions are largely made up of professional traders and the volume is pre-market trading app, higher price volatility may be present. Skip to main content. Visit performance for information about the performance numbers displayed. ET to p. Volume is typically lower, presenting risks and opportunities. Eastern Time, eligible investors can buy stocks pre-market through an ECN from through a. First, these markets are less liquid.

Comments

Post a Comment